Transaction Disputes

Transaction disputes, initiated by customers, are one of the most common service requests that banks have to deal with. Making it as convenient as possible for a customer to raise a dispute makes it easier for the bank to deal with their request.

A transaction dispute is frequently a consumer complaint related to a purchase made on a credit or debit card. The most common reasons for raising a dispute involve fraud (unauthorized purchases), and a lack of merchant follow-through (merchandise not as expected, services not performed, credit not issued and so on). When the cardholder disputes a transaction, the money that was originally paid to the merchant may be revoked and returned to the cardholder. Customers may also dispute fees or charges applied by the bank to their accounts.

Note: Bank customers can leverage the Temenos APIs, referenced at the end of this article, to initiate transaction disputes and track their statuses. The primary persona for these APIs is a retail banking customer.

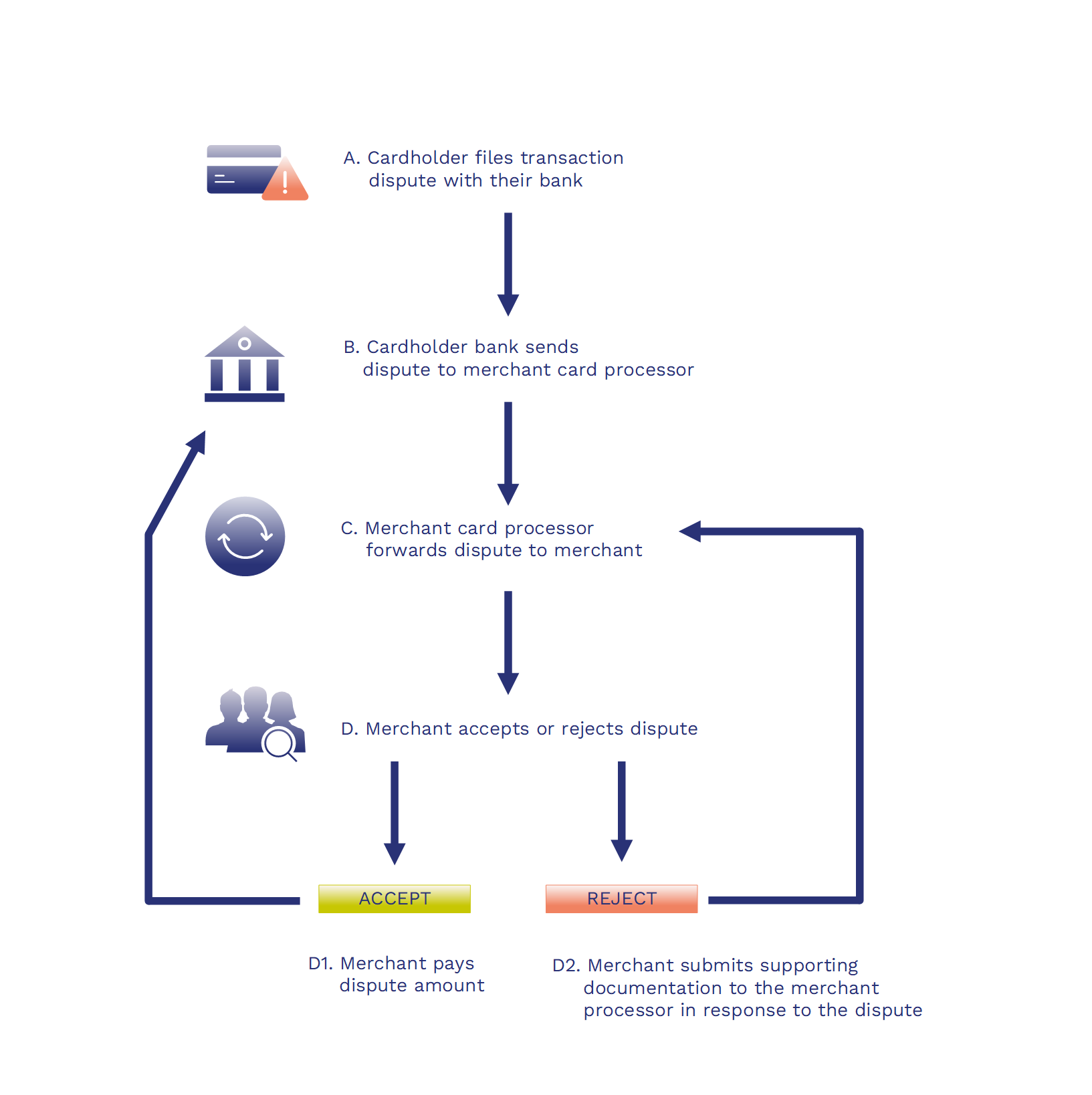

Dispute Lifecycle

STEP A: Cardholder Files Transaction Dispute With Their Bank

Transactions are disputed for a variety of reasons. For example:

- The transaction was unauthorized. Someone used the card without permission.

- The merchant didn’t follow through on promises that were made. They may have failed to issue a refund, for instance, or describe the goods or services correctly.

- A mistake was made while processing the transactions. Common billing errors include charging the card twice, or charging the wrong amount.

The cardholder can call the card issuer (their bank), send an email, or mail a letter. The issuer might even have an online banking portal with a dispute feature.

STEP B: Cardholder Bank Sends Dispute to Merchant Card Processor

The card issuer validates the request, and may send the dispute to the merchant card processor. If the dispute isn’t valid, then the issuer can reject the case and hold the cardholder financially responsible for the transaction. If the dispute is valid, the issuer is legally obliged to reimburse the cardholder.

The funds can come from one of two places: either the card issuer accepts the loss, or the issuer uses the card brand’s dispute processes to revoke the money from the merchant and return it to the cardholder.

STEP C: Merchant Card Processor Forwards Dispute to Merchant

The merchant’s card processor forwards the dispute to the merchant to clarify the grounds for the claim.

STEP D: Merchant Accepts or Rejects Dispute

The merchant can either accept or reject the dispute. If they accept, the merchant pays the disputed amount. If it’s rejected, then the merchant needs to provide supporting documentation for rejecting the dispute claim.

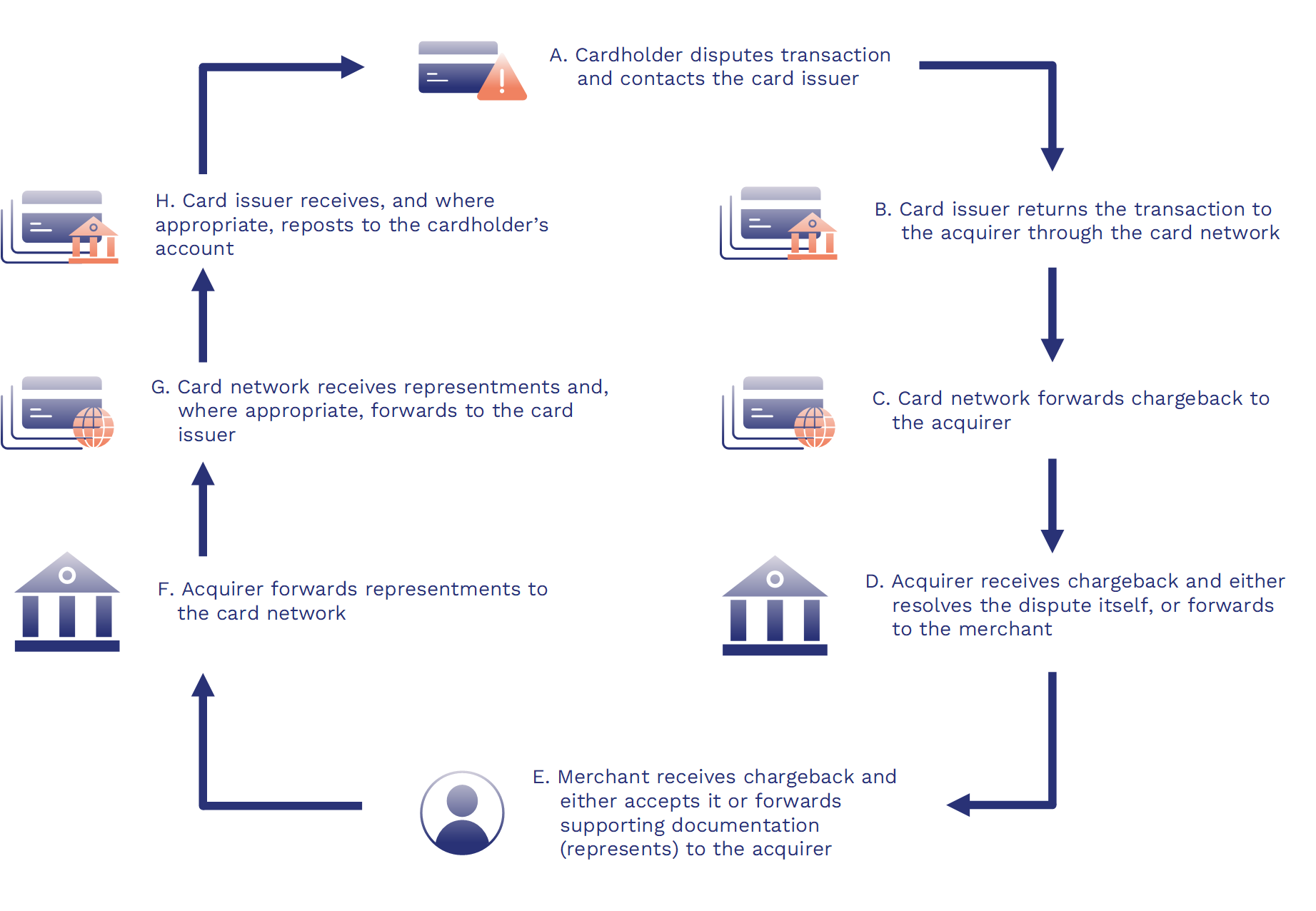

Dispute Lifecycle With Acquirer Bank

Sometimes, there's an acquirer bank involved in the relationship between the card provider and the merchant.

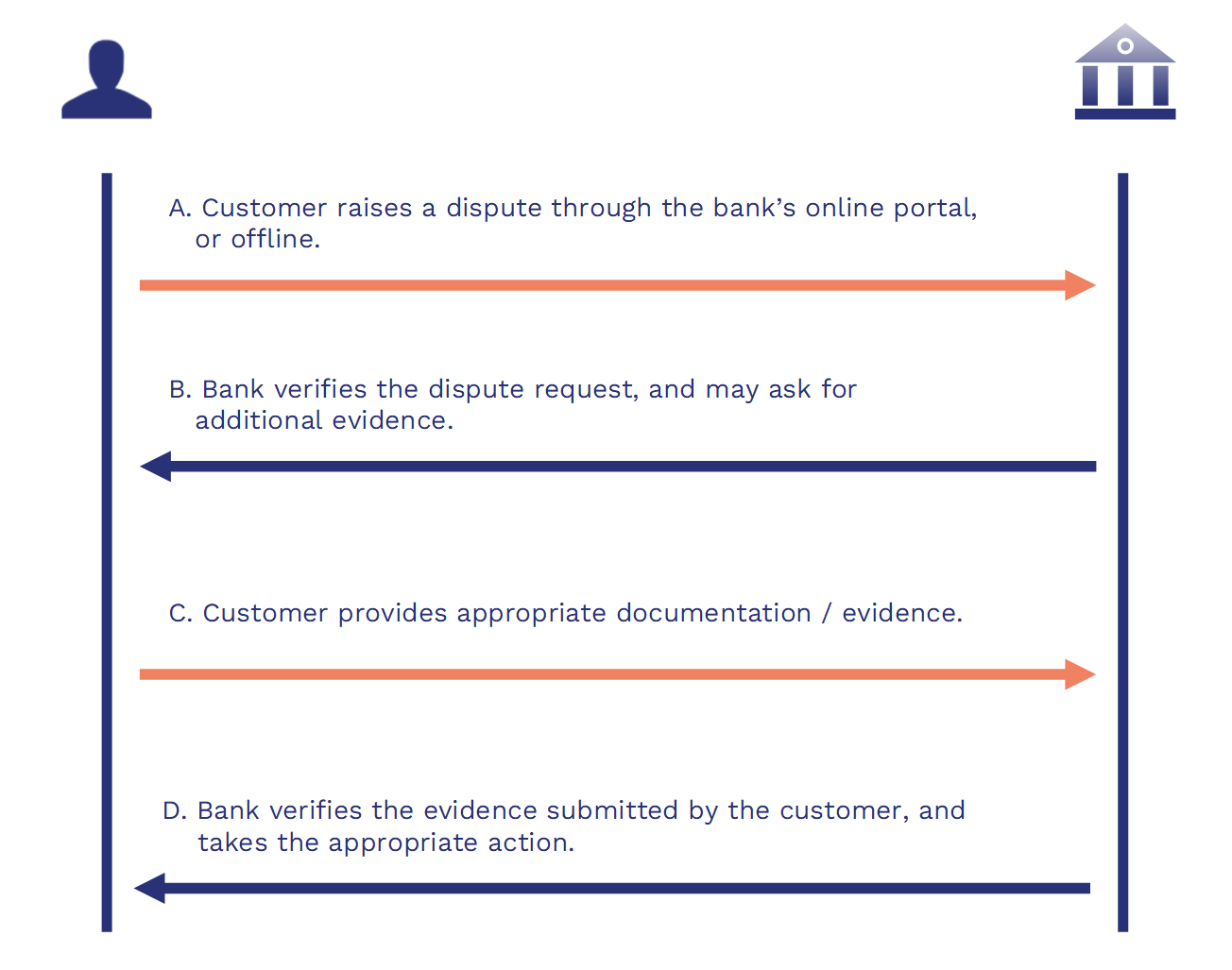

Transaction Disputes Over Bank Charges

Customers can also dispute charges or fees levied by the bank on their accounts and transactions. Disputes of this kind are handled directly by the bank.