Card Management

Cards are an integral part of the bank’s business with their customers. The bank offers cards in several variants, starting with debit and credit cards, in both physical and virtual forms. Cards are based on products that define how the card is used, through transaction limits, fees and charges, reward programs, and cashback.

Card APIs need to cover the complete lifecycle of cards, from issuance, through to activation, management, and termination. While Debit cards are issued only to existing account holders of the bank, credit cards and pre-paid cards can be issued to new applicants. When a user applies for a (credit or pre-paid) card on the bank’s website, the first question they’re asked is whether they’re an existing customer or not.

If the answer is YES, then the existing customer enters the customer id and account Id that will be associated with the new card and chooses from a list of card products.

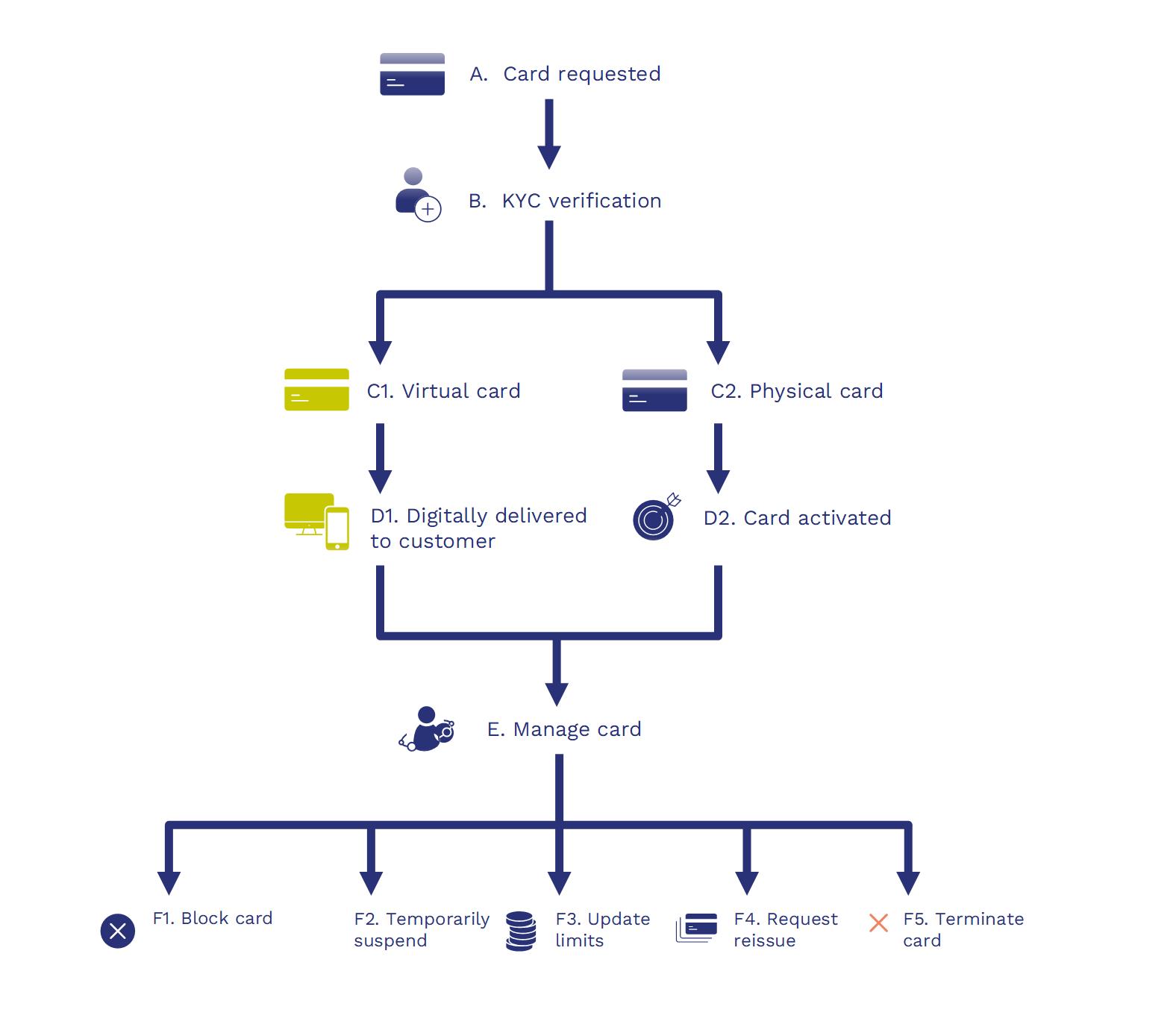

The following diagram shows the card lifecycle from a customer perspective:

STEP A: Requesting a Card

The lifecycle initiates when a new or existing customer requests a card (a credit, debit or pre-paid card) on the bank’s website, or through Internet banking.

If the user is an existing customer of the bank, then the request is initiated using the customer and account ID.

If they’re a new customer, then the user needs to provide complete KYC (Know Your Customer) related information to the bank.

STEP B: Verifying new customers

If the applicant is a new customer, the required KYC (Know Your Customer) verification is performed according to standards defined by the bank.

Once the user is verified, the bank creates customer details and an account for the user. The card issued is then linked to the newly created account.

STEP C: Delivering the Card

Some banks offer digital cards. These are provided digitally to the customer, once KYC (Know Your Customer) verification has been completed.

The customer can start using the card for purchases and online shopping right away, as the digital card is instantly activated.

Physical cards are usually dispatched to the customer within 2-3 business days.

STEP D: Activating the Card

Once the customer receives the physical card, they can activate the card in a number of ways, by calling the bank’s customer care service, for example, or through phone banking, or Internet banking.

The card PIN mailer is usually sent separately from the card and the customer can change the PIN can through either ATMs or Internet banking.

STEP E: Managing the Card

The bank responds to customer activity, including requests and inquiries, and to any security alerts that come back through monitoring. The bank makes changes to the card data and status when appropriate.

Note: The card management API endpoints are covered by the sections below.

STEP F: Endpoints To Manage Lifecycle

STEP F.1: Block Card

If the user has lost the card or if the card has been stolen then the card needs to be blocked right away to prevent misuse.

The user calls the bank's customer care and informs the agent on the loss of the card; The card will be blocked right away to prevent misuse and the user can request for a replacement.

STEP F.2: Temporarily Suspend

If the user has lost the card or if the card has been stolen then the card needs to be blocked right away to prevent misuse.

The user calls the bank's customer care and informs the agent on the loss of the card; The card will be blocked right away to prevent misuse and the user can request for a replacement.

If the card is returned or found the card can be reactivated and used as normal.

STEP F.3: Update Limits

This endpoint covers the below scenarios:

- User requests for a Limit update (could be limit increase or decrease).

- User tries to block the card.

- User tries to unblock the card.

- User reports the loss of the card.

STEP F.4: Request Reissue

The user can request a new card for a variety of reasons including card damage, display name change, change of image on card*, change of card product*, or when the card has been lost/stolen.

The reason determines whether or not the reissue card's details remain the same as the old card and when the old card is de-activated.

For instance, if the card renew request is due to a name change - then the card id, PAN, cvv etc remain the same as the existing card, and the old card issued remains active until the new one is activated by the user.

However, if there is a replacement request owing to loss/theft of the card, then the new card issued will have a different PAN and card id. The old card is terminated immediately and the new one needs to be manually activated by the user.

STEP F.5: Terminate Card

The user can request for termination of the card (Card cancellation) in case he/she does not wish to use the card anymore.

Once the card cancellation request is placed, the Bank might perform some additional validation such as checking to see if all dues have been paid out. Validation usually takes 2-3 business days and once the validation is complete, the card will be canceled.