International Payments

Tip: To use the Temenos developer sandbox, you'll need an API key. To learn more, see the Sandbox Guide.

International payments, also known as cross-border payments or global payments, are transactions that involve more than just banks. They connect companies, individuals, banks and settlement institutions operating in at least two different countries with different currencies.

Cross-border payments occur when both of the parties involved in the transaction are registered in different countries. The most popular cross border payments methods include wire transfer, credit cards, and alternative payment methods such as mobile wallets, and other low value payment methods. All interactions for payments happen between the parties - the buyer and seller, or the ordering customer and the beneficiary customer - through their respective banks. The banks communicate with each other through the SWIFT mechanism for international transactions.

International Payment Lifecycle

International Payment Lifecycle Roles

Ordering Customer

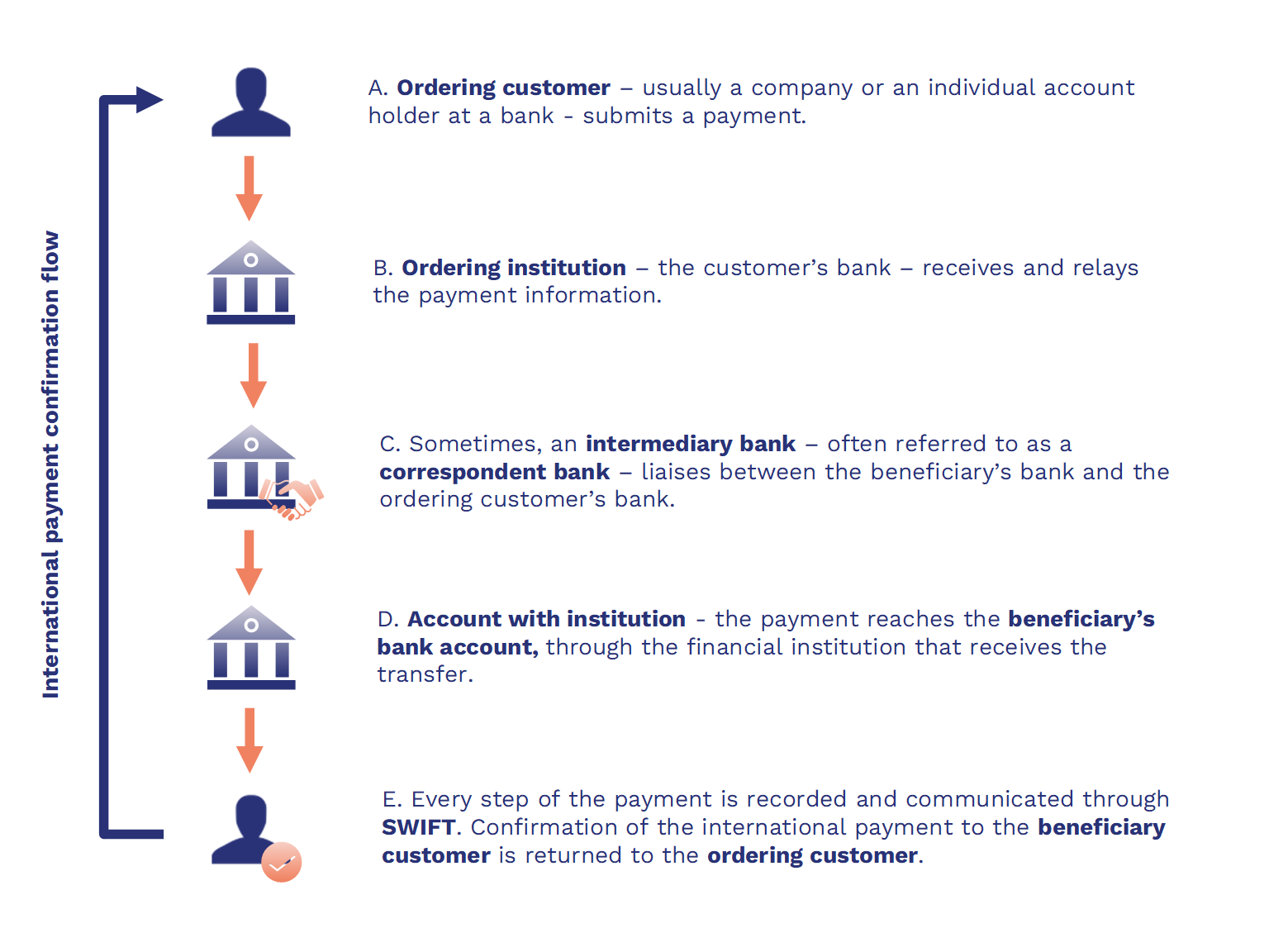

The ordering customer is either an individual or an entity who is looking to make an international payment to an overseas beneficiary.

For example, you're an individual or a company in India that wants to purchase a service from a marketing company in the UK. In this case, you'll probably use a designated credit card that’s tied to their company's bank account to make a payment to the company in the UK. However, before this happens, the ordering institution will be notified.

Ordering Institution

An ordering institution is the financial institution that receives your instructions to transfer funds from your bank account to the seller. If the credit card account is with American express for example, then AMEX will begin the transfer of funds from your account.

Intermediary Institution

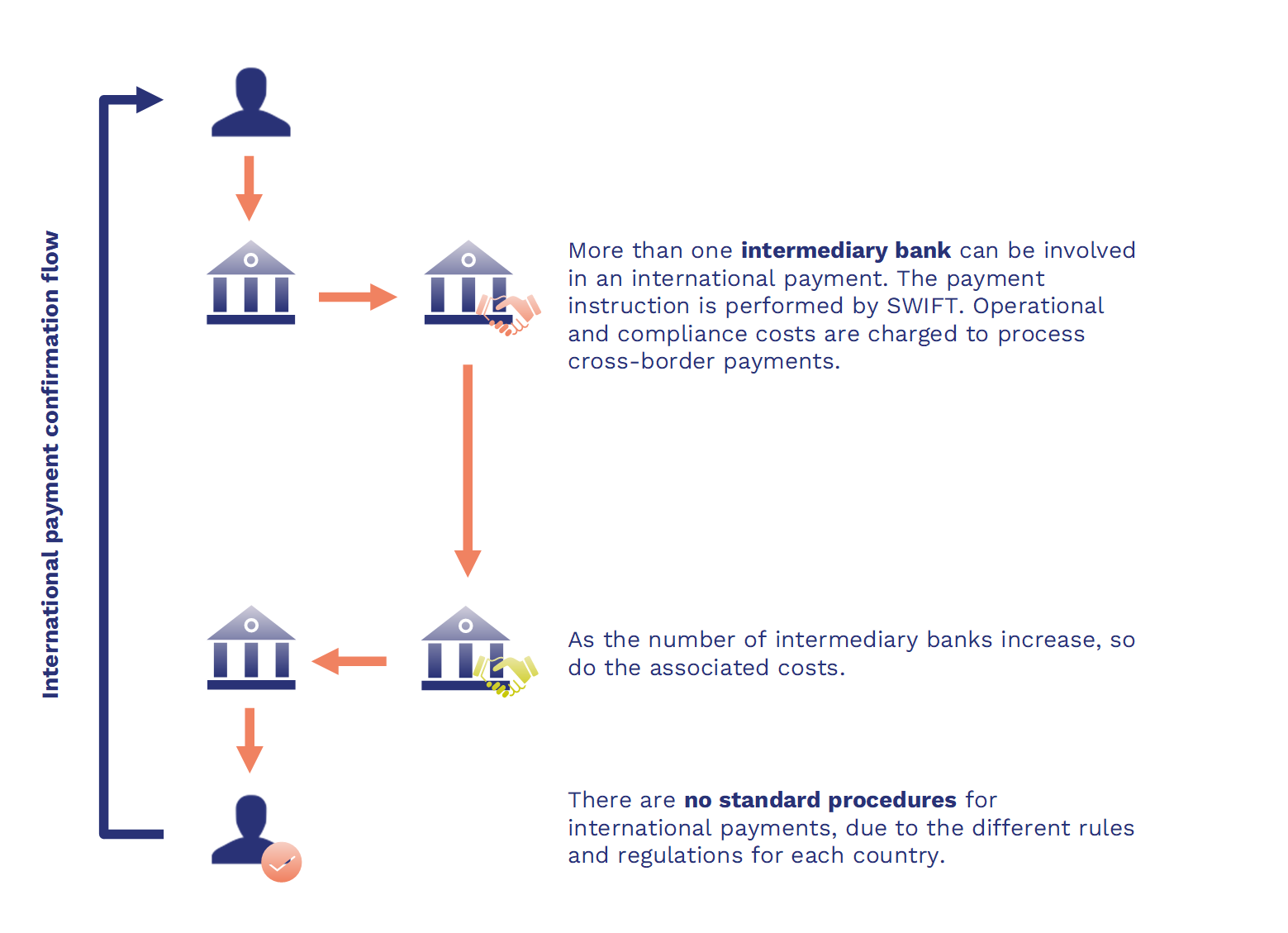

Most banks don’t offer or buy foreign currency. Instead, banks pass specific information along about who the recipient is, what his/her bank account number is, and how much money he/she is receiving to a financial intermediary. Your bank will then settle all payments on the back end.

With international wire payments, you can transfer your money to as many as (but not limited to) three intermediary banks - all of which apply FX (Foreign Exchange) fees, which could make your transaction more expensive.

Account with Institution

Before your money reaches the seller’s company, it goes to the the financial institution that receives the payment from the Ordering Institution, either directly or indirectly through an Intermediary Institution.

This financial institution will then make the funds available to the beneficiary customer by crediting his/her/its bank account with the funds you transferred (paid) over to them.

Beneficiary Customer

The beneficiary - the person or company to whom you’re making an international payment - is the final entity involved in the international payment. Beneficiary customers receive their money through their bank account (account with the institution).