Card Management Domain Adapter Guide

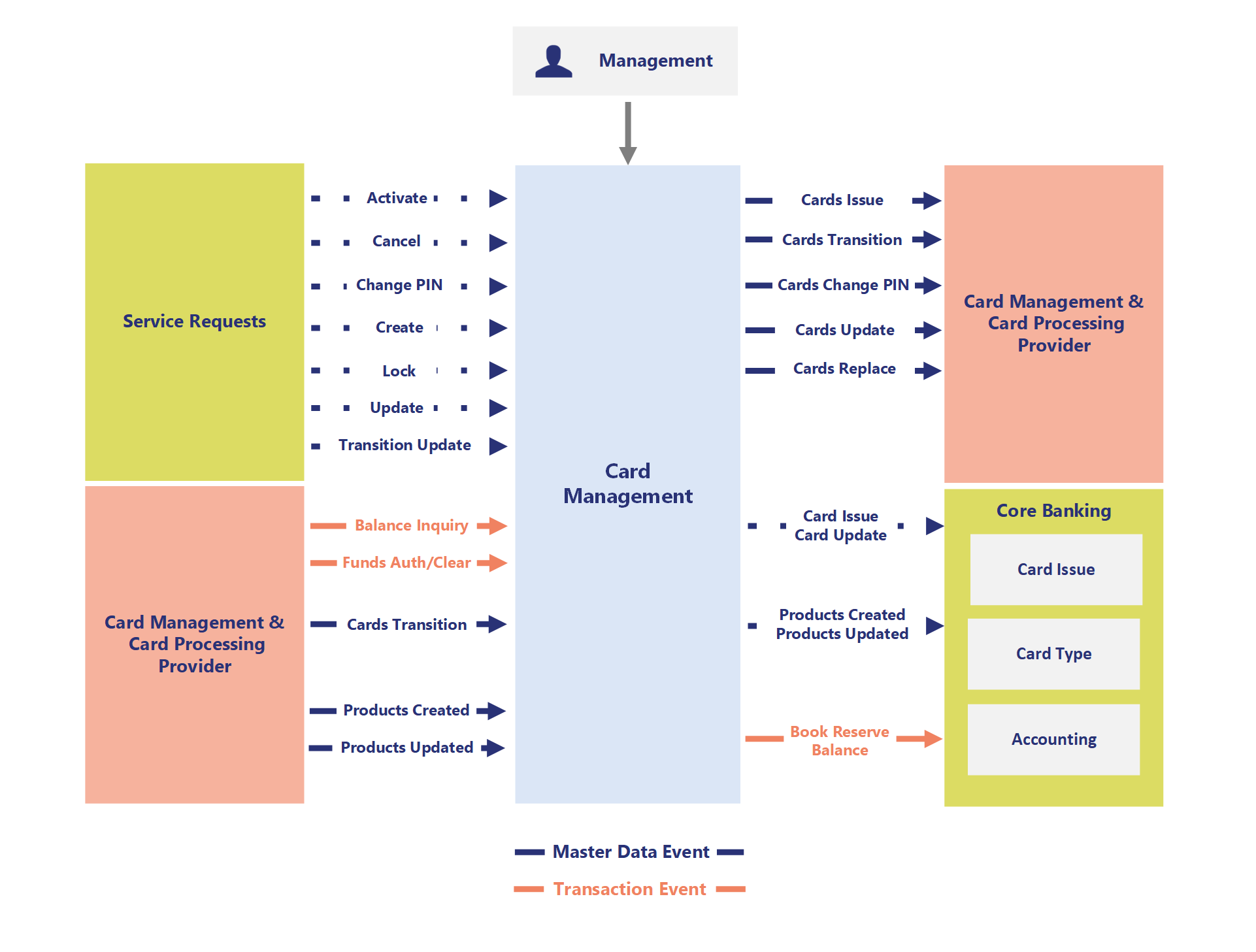

This guide centers on a context diagram representing the interactions of the Card Management System with its surrounding entities. The diagram, which focuses on the card lifecycle, events and processes, is followed by a description of the roles, responsibilities, and flows.

Note: Click the diagram to expand.

Service Requests

Note: See top left component of the context diagram.

Roles

This component represents user-initiated actions and requests submitted to the Card Management System. These requests could come from users, systems, or customer service representatives.

Key Actions

- Activate: Activates a newly issued or previously locked card.

- Cancel: Cancels an existing card, typically when it is no longer required.

- Change PIN: Updates the card's PIN for security or user preference.

- Create: Issues a new card request, which involves interacting with downstream providers.

- Lock: Temporarily locks a card, often for security reasons (for example, suspected fraud).

- Update: Updates cardholder details or card attributes.

- Transition Update: Reflects changes in the card's status (for example, transition from inactive to active).

Flow

Service requests flow into the Card Management System to trigger lifecycle actions.

Card Management

Note: See central component of the context diagram.

Role

The Card Management System is the primary orchestrator, coordinating all card-related processes, data management, and integrations. It processes incoming requests and delegates tasks to downstream systems.

Functions

- Handles card lifecycle actions triggered by Service Requests (for example, Create, Activate, Cancel).

- Publishes Master Data Events to notify downstream systems of updates (for example, products created, products updated).

- Facilitates Transaction Events for financial operations such as balance inquiries and funds authorization.

Data interaction:

- Receives service requests, processes them, and communicates with downstream components.

- Ensures card data integrity and consistent state transitions.

Card Management and Processing Provider

Note: See top right component of the context diagram.

Roles

This external provider manages backend processes related to card issuance, updates, and lifecycle transitions.

Key interactions with Card Management

- Cards Issue: Fulfills card issuance requests (for example, printing and shipping).

- Cards Transition: Handles transitions like upgrades or replacements.

- Cards Change PIN Processes secure PIN changes.

- Cards Update: Applies general updates to card attributes.

- Cards Replace: Processes requests to replace lost, stolen, or damaged cards.

Flow

Card Management sends instructions to the provider for execution. The provider sends back status updates and notifications.

Core Banking

Note: See bottom right component of the context diagram.

Role

The Core Banking System supports financial operations, enabling real-time card transactions and reconciliation with user accounts.

Key Functions

- Accounting: Manages financial records and reconciliation of transactions.

- Card Issue: Associates newly issued cards with customer accounts.

- Card Type: Links card types (for example, debit, credit) with banking products.

- Balance Inquiry: Provides real-time account balance information for the cardholder.

- Funds Authorization/Clearing: Authorizes and clears financial transactions initiated via cards.

Flow & Actions

Card Management interacts with Core Banking for financial operations, ensuring synchronization of cardholder account data. Transaction Events, such as balance inquiries and funds authorization, flow in real-time.

- Quotes and Transfers: The system validates the inputs, processes the requests, and sends back calculated quotes or transfer confirmation statuses.

- Transfer List and Details: The system fetches the transaction history or pending transfers from the appropriate data stores and returns it to the user.

Card-related Events

Master Data Events

Note: Master data events = dark blue dotted lines.

Role

Master data events represent updates or changes to card-related metadata, such as product configurations or card state transitions. These events ensure downstream systems remain in sync with the latest card configurations and status.

Events:

- Cards Transition: Indicates a change in the card's lifecycle status (for example, activation, deactivation, or upgrade)

- Products Created: Signals the creation of new card-related products or features (for example, a new card type such as Platinum Debit).

- Products Updated: Indicates modifications to existing product configurations (for example, changing product fees or benefits).

- Cards Issued: Notifies downstream systems when a card is successfully issued.

- Cards Updated: Reflects general updates to card metadata.

- Cards Replaced: Indicates that a card has been replaced due to being lost, stolen, or damaged.

Transition Events

Note: Transition events = coral solid lines.

Role

Transaction events capture real-time activities related to the card's financial operations and balance management. These events ensure accurate synchronization with core banking systems and other financial entities.

Events:

- Balance Inquiry: A real-time request to fetch the current balance associated with a card.

- Funds Authorization/Clearing: Tracks and processes financial transactions initiated by cardholders, including reservation of funds and settlement.

Management

Note: See top of context diagram.

Role:

Management oversees observability and operational health of the Card Management System. This includes providing insights and control to operators.

Functions:

- Observability: Logging, metrics, and traces for the system's behavior.

- System Management: Readiness checks, heartbeat monitoring, state management, and enabling detailed logging for debugging.

- Integration: In SaaS environments, management is typically integrated with an overarching system management solution.

Related Guides

See also: