User Agents

User agents are designed to provide a first-class, responsive user experience. Temenos is producing many new user agents. To see quick summaries of their business functionality refer to the details after this introduction.

Introduction

A user agent refers to any UX application that provides functionality focused on a particular business role.

These web applications can be grouped together under one common application. This master application is know as Temenos Explorer (TEX).

It provides simple runtime services for all the user agents that run within. These include cross user agent navigation, user level preferences, a common API execution function etc.

A key feature is that it provides seamless access to native Transact screens. This means a user agent can be a mix of first-class hand crafted and convenient Browser screens.

User agents are developed to adhere to the TEX contract. This contract is very simple and lightweight and gives access to the TEX services.

A small SDK is provided to be able to rapidly construct user agents. This is the Temenos Explorer Starter Kit. See: Link to Starter Kit plugin

Use and Customisation

The customisation of user agents depends on 3 factors:

- By agreement. Certain user agents may not be customisable.

- How they are deployed

- On prem and client cloud: Full customisation is allowed.

- Temenos SaaS: Customisation is controlled within guard rails in accordance with our SaaS policy.

Full customisation

This applies if the user agent is NOT running in Temenos SaaS i.e. on Prem, client’s own cloud etc.

In this case, the user agent is provided as an accelerator / template app. This pack includes the full source and SDKs. The client may change any aspect of the user agent to suit their own requirements.

Customisation is done using Javascript. Any industry standard Javascript development tooling can be used.

Guard rail customisation

For SaaS, customisation is highly controlled in accordance with our SaaS policy. This means that the client customisations (Javascript) are deployed into SaaS to the Generic Config Microservice using the Temenos Workbench and Packager. Customisations are limited to changing existing screens i.e. new screens cannot be added.

Deployment

User agents are deployed within Temenos Explorer as a static web site. User agents are stateless. Any application logic is executed either in the user’s web browser and or behind the APIs that serve the screens. This means any light weight web server can be used. For example

- NodeJS

- Java based (Wildfly, Jetty, JBoss)

- Native (Nginx, Apache)

Distribution

We have developed multiple user agents, as explained below. Clients can avail those from Temenos Distribution Team ([email protected]) :

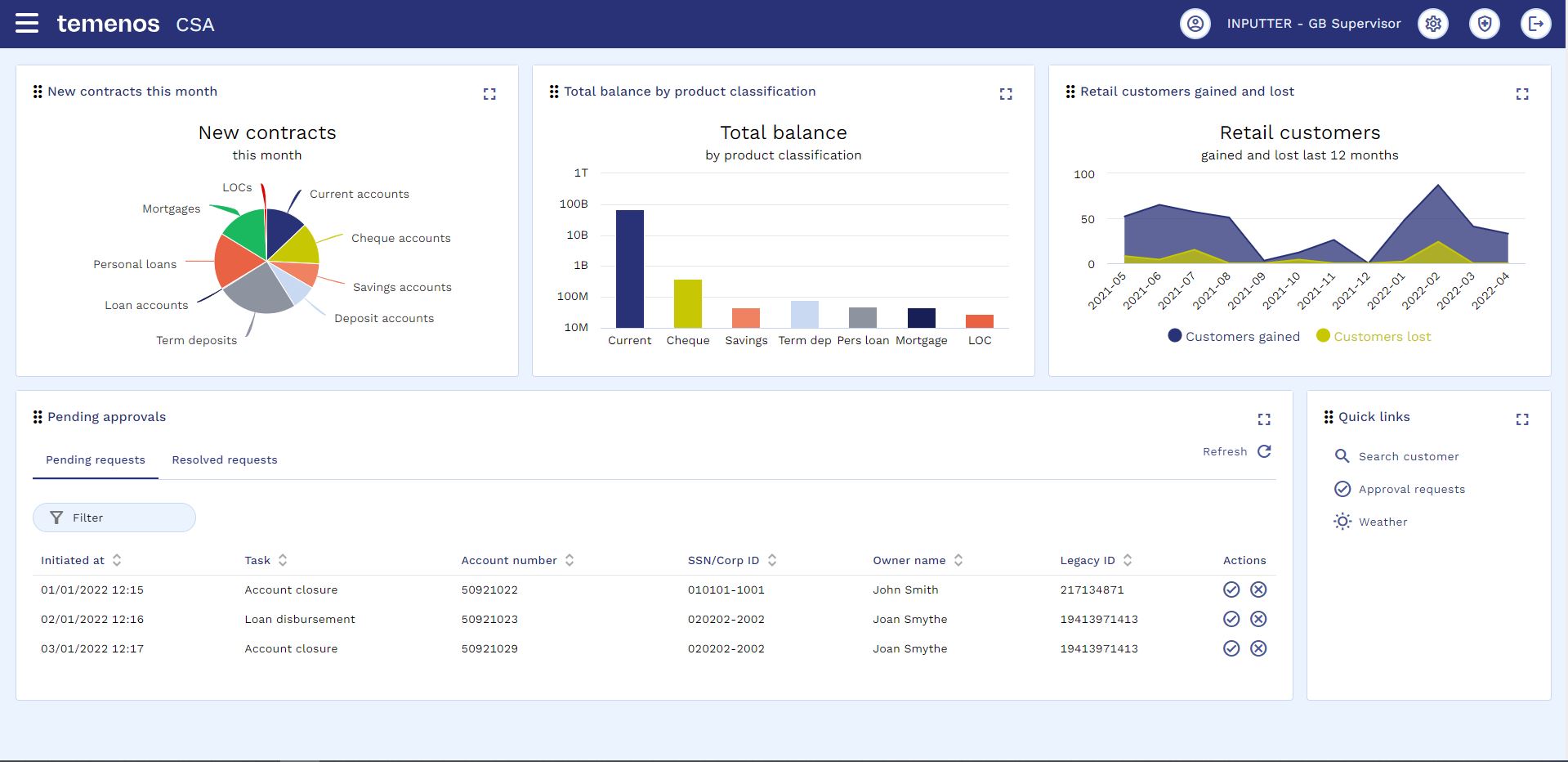

Customer Service Agent UA

Customer Service Agent (CSA) user agent is designed to encompass the Assisted Channel banking activities using a modern and fast interface with minimal representation layer. CSA provides the bank users with efficient access to customer details and allows to service their accounts. CSA is integrated with Temenos XAI and Analytics and can provide various customer insights and balance predictions.

What is it currently possible to do with Customer Service Agent?

- Search for a customer or account

- 360° view of customers and their holdings

- View XAI data like Balance prediction, and Next best product

- Edit or add new address

- View account information and balances

- Edit account roles

- Edit posting restrictions

- Add a standing order

- Edit the interest rates

- Edit settlement's accounts

- Calculate payoff amount

- Edit term of a loan

- Close an account

How does it work with Transact and other cores?

Though CSA is independent of the underlying technology and can “talk” to different core systems, we have released Transact flavor of CSA where the screens and business functions are using Transact IRIS APIs.

Where can I find the technical documentation?

User guide is available here Temenos docs page

Where can I find the demonstration of Customer Service Agent?

Demo video of CSA

Note: The scope of this User Guide is the Transact flavour of CSA where all the screens are “wired” to Transact by using IRIS APIs. However, as CSA uses industry standard technology, CSA can be wired to Temenos Microservices and many other systems.

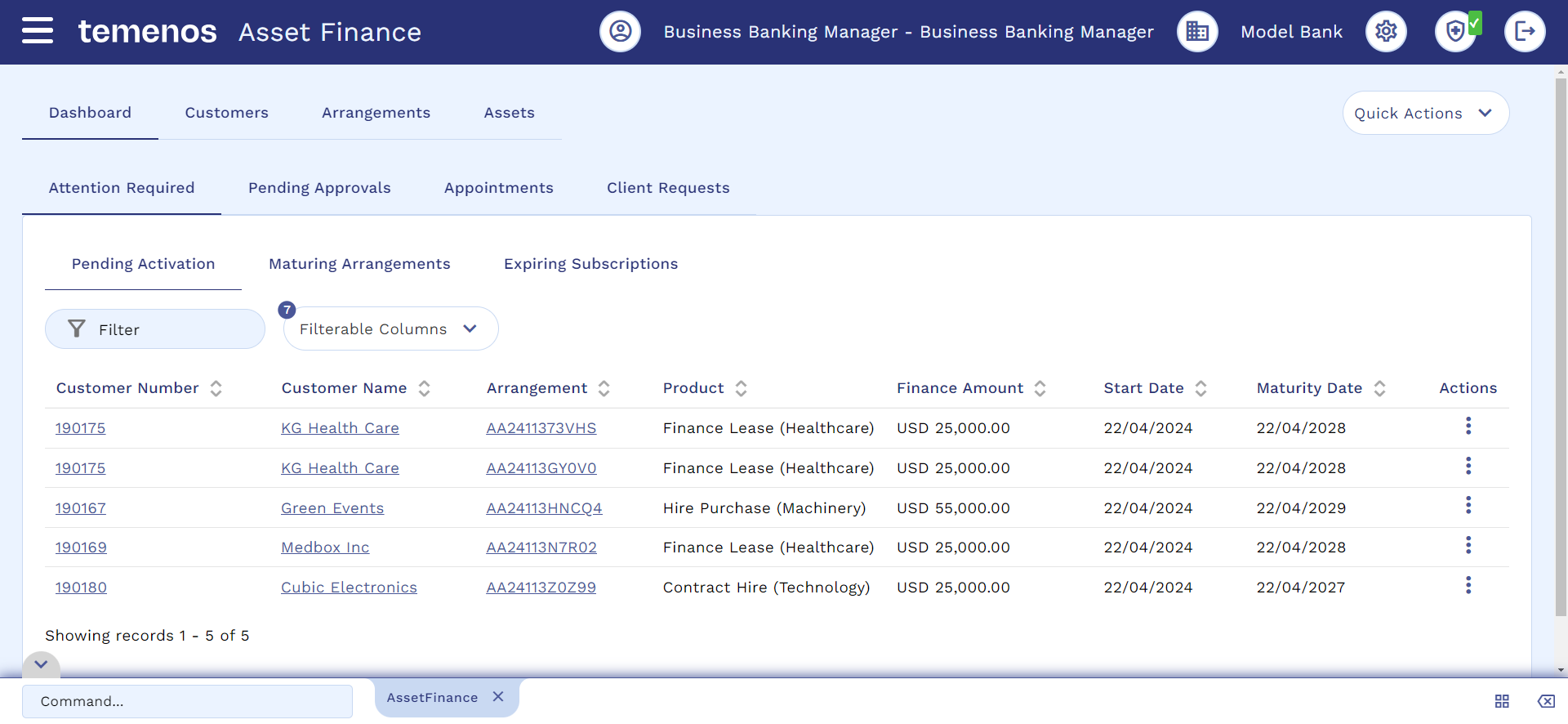

Asset Finance UA

Asset finance is a method of providing finance for hiring or purchasing tangible assets.

Asset Finance, one of the user agent of Temenos Explorer, allows banks to define and launch products such as-

- hire purchase

- finance lease

- contract hire/operating lease

for various asset classes, such as vehicles, equipment, plant and machinery, and land and buildings.

What is it currently possible to do with Asset Finance UA?

- Search for a customer, based on search criteria

- Search for an arrangement based on Customer number, Arrangement, Product Group and Product

- Search for an Asset based on Supplier, Asset Class, etc.

- 360° view of customers and their purchase

- Quick access menu provide easy access to create new arrangement and asset, activate arrangement, Pending Approvals and Appointments, and much more

- Other features include Payment Holiday, Document Center, Outstanding Bills, Subscription, Pricing

- Access to view beneficiaries, view balance, and recent transactions with just one click

- Overview functionality for Assets gives the detailed view of asset details, valuation details, maintenance details, inspection details, insurance details, usage details, and incident details

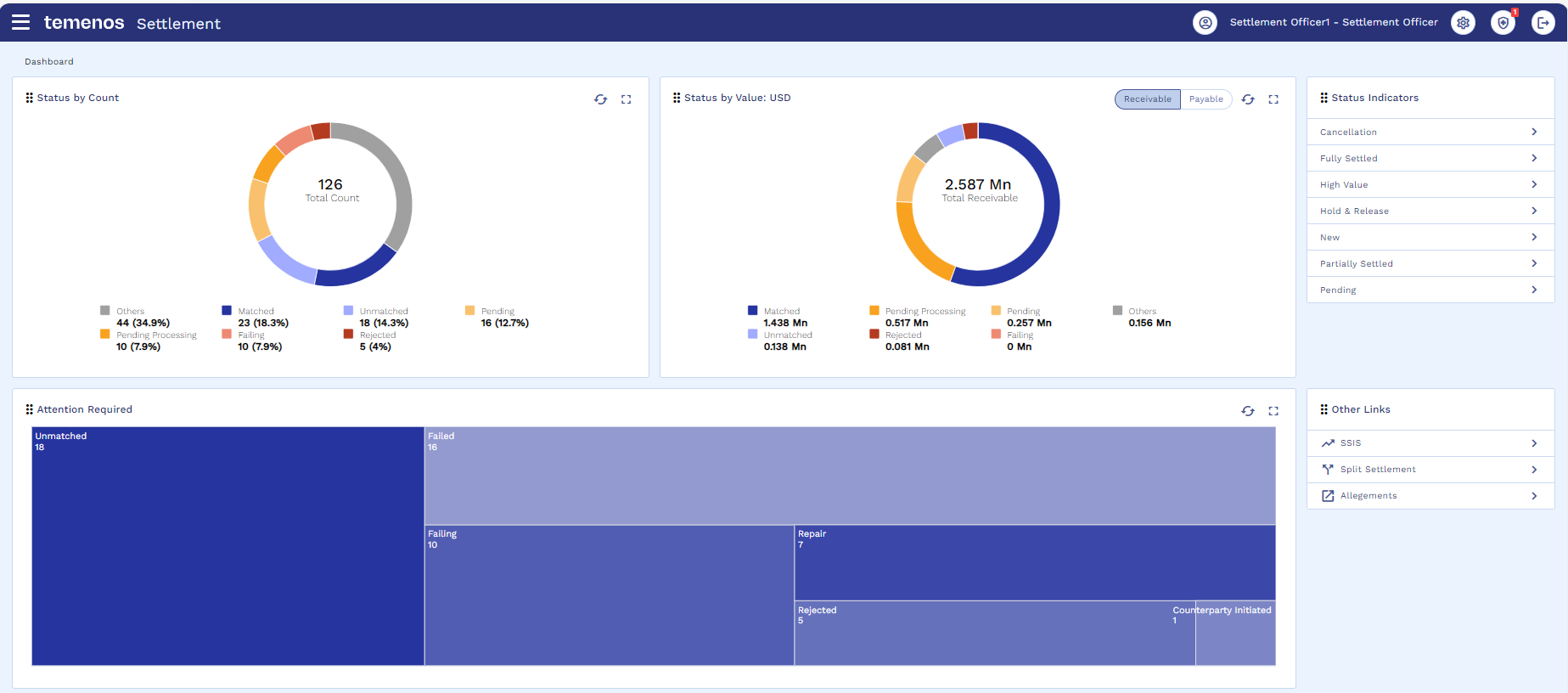

Settlement Cockpit UA Dashboard

The settlement dashboard from Temenos provides a 360° view of all the outstanding settlements that allows the users to identify the potential problems early and initiate timely corrective measures.

The dashboard provides a comprehensive view of all the open settlement transactions with a status wise split of the same.

Certain transactions requiring immediate attention of the users are highlighted so that these can be looked at on priority. These are based on statuses, namely:

- Unmatched

- Rejected

- Repair

- Failing

- Failed

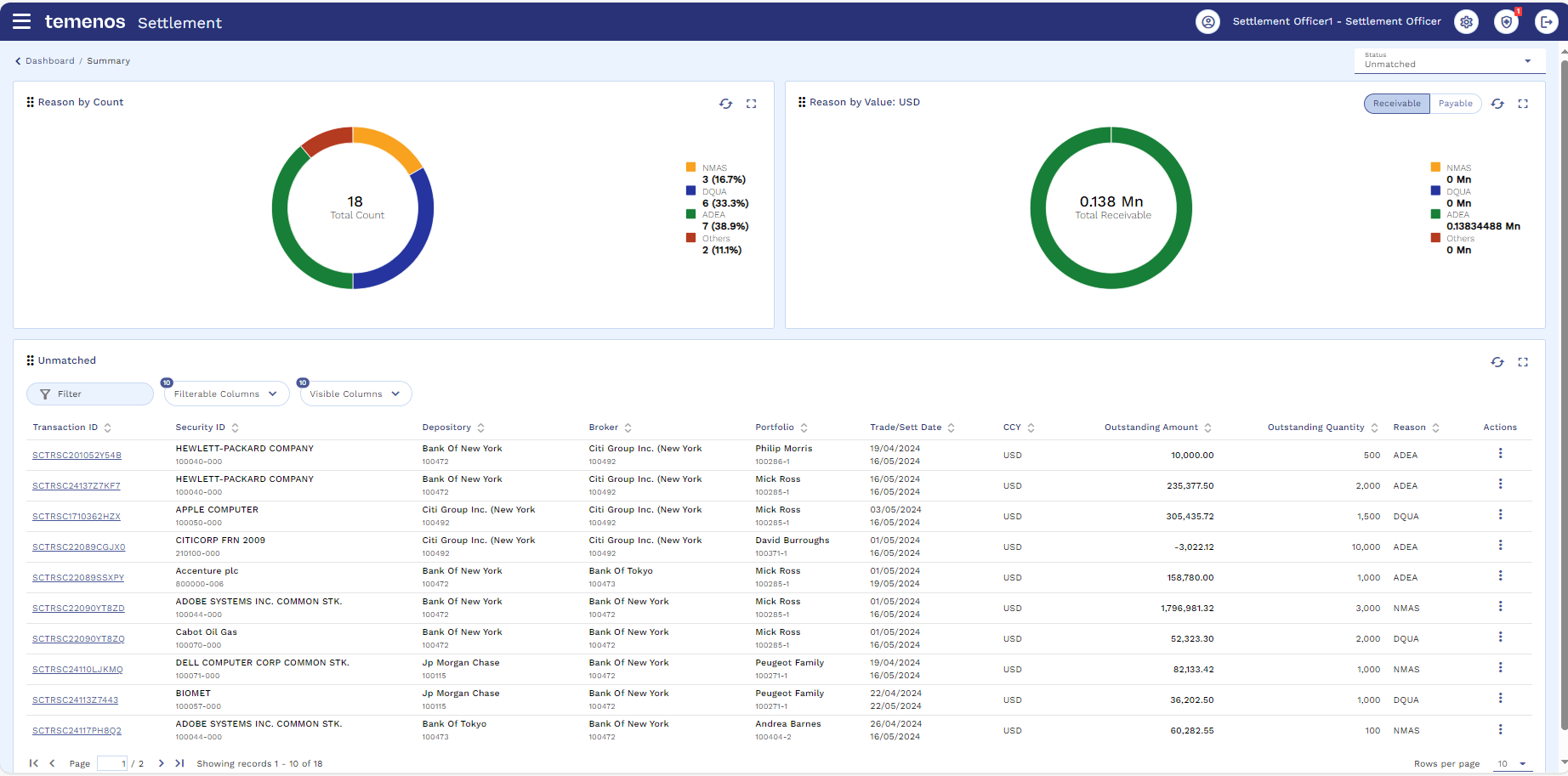

The users can drilldown from the landing page to view the underlying transactions list and reasons for the status (for example: Unmatched – Account servicer deadline missed).

The details of reason codes that we have for various statuses are given below:

| Status | Reason Codes |

|---|---|

| Pending Processing | Account Servicer Deadline Missed, Account Blocked, Hold, Others |

| Rejected | Account Servicer Deadline Missed, Invalid settlement date, Invalid PSET, Others |

| Unmatched | Account Servicer Deadline Missed, Matching process not started, Qty mismatch, Others |

| Pending | Account Servicer Deadline Missed, Account Blocked, Hold, Others |

| Failing | Account Servicer Deadline Missed, Account Blocked, Lack, Others |

| Repair | Invalid security, Invalid settlement date, Invalid PSET, Others |

The other features of the dashboard include:

- Tracking cancellations – status of cancellation requests either initiated by the bank or by the counterparty.

- Track the transactions on hold either by the bank or the counterparty and their release status.

- Focus on high value transactions to prioritize the same.

- View and manage the SSIs.

- Track securities allegements

Besides, viewing the list of the transactions, the system also allows performing specific actions (through deep links to Transact via the Transact explorer). These actions could range from manually settling the transaction (partial/full) to reversing/rebooking the parent transaction.

Settlement UA User guide is available here Settlement docs page

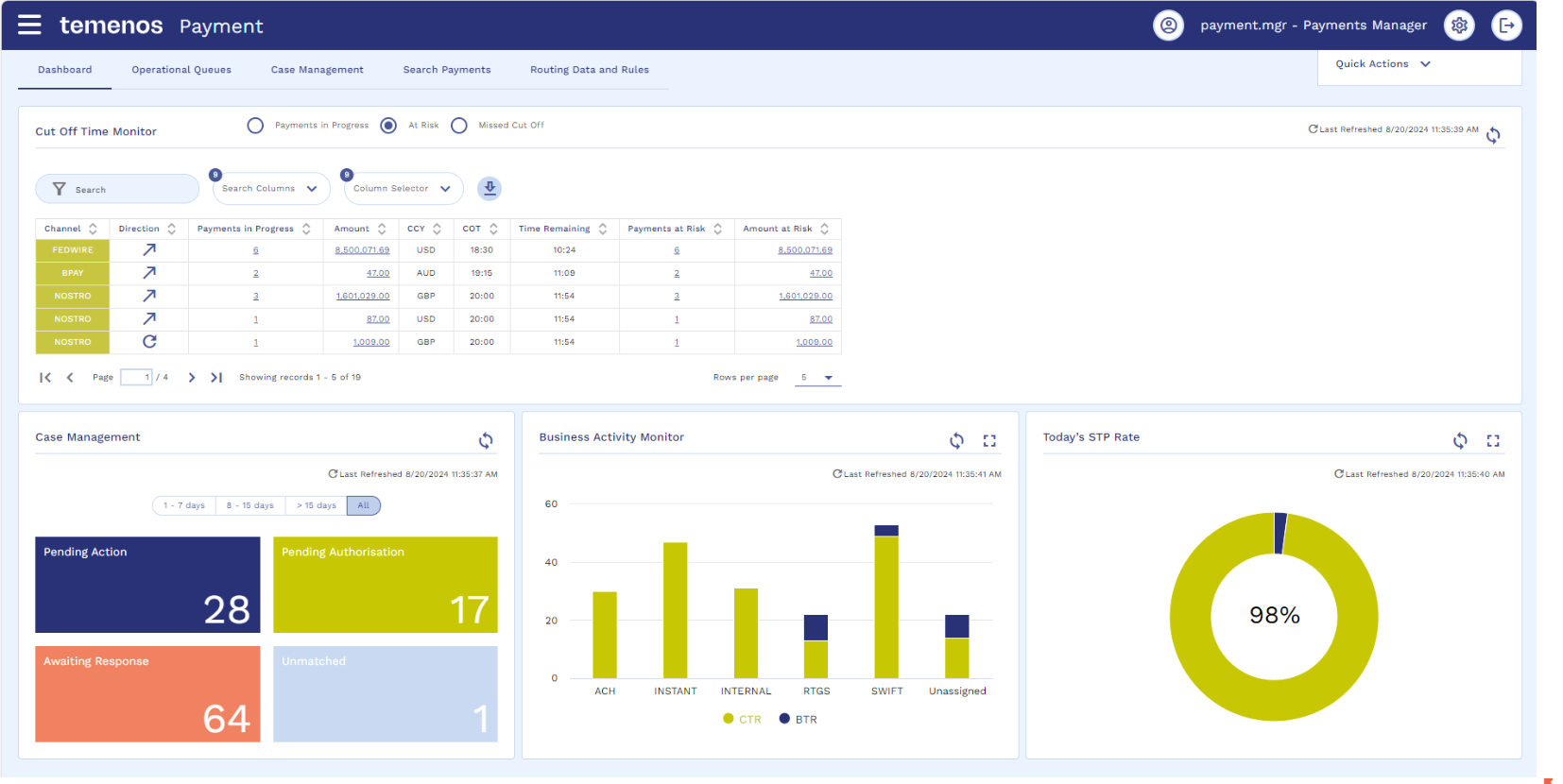

Payments Operations UA

The Temenos Payment user agent offers users detailed insights specific to payments, presented in a donut chart that displays the count of statuses based on the criteria selected in the toggles and filters. It provides a holistic and end-to-end view of the transactions, including any associated items such as payment returns, payment recalls, and so on. It is designed to access accurate information with fewer clicks. It is a role-based interface that provides different views for Payments Operator, Manager, and Admin roles, respectively.

The Payments UA provides the following features,

- Cut-off Monitor – Displays payments and their cut-off times.

- Case Management – Displays pending cases, cases awaiting a response, and so on. Includes both MT and MX format case management messages and enables a case view for each payment.

- Business Activity Monitor – Displays ACH, RTGS, Instant, and Cross Border payments that are both processed and unprocessed.

- STP Rate – Displays STP and non-STP payments for the current day and the past 30 days.

- Queues - Provides the list of payments pending for action, authorisation, or response from external systems. It also contains payments in warehouse (Future dated payments) as well as payments awaiting to be sent to clearing or payments awaiting acknowledgement from clearing or SWIFT.

- Track payments – Efficiently monitors and accesses payments.

- Initiate payments – Initiates outward and book payments.

- Configure payments – Configures Temenos Payments Hub to suit custom needs.

More information on Payments User Agent can be found at: Payments UA docs page

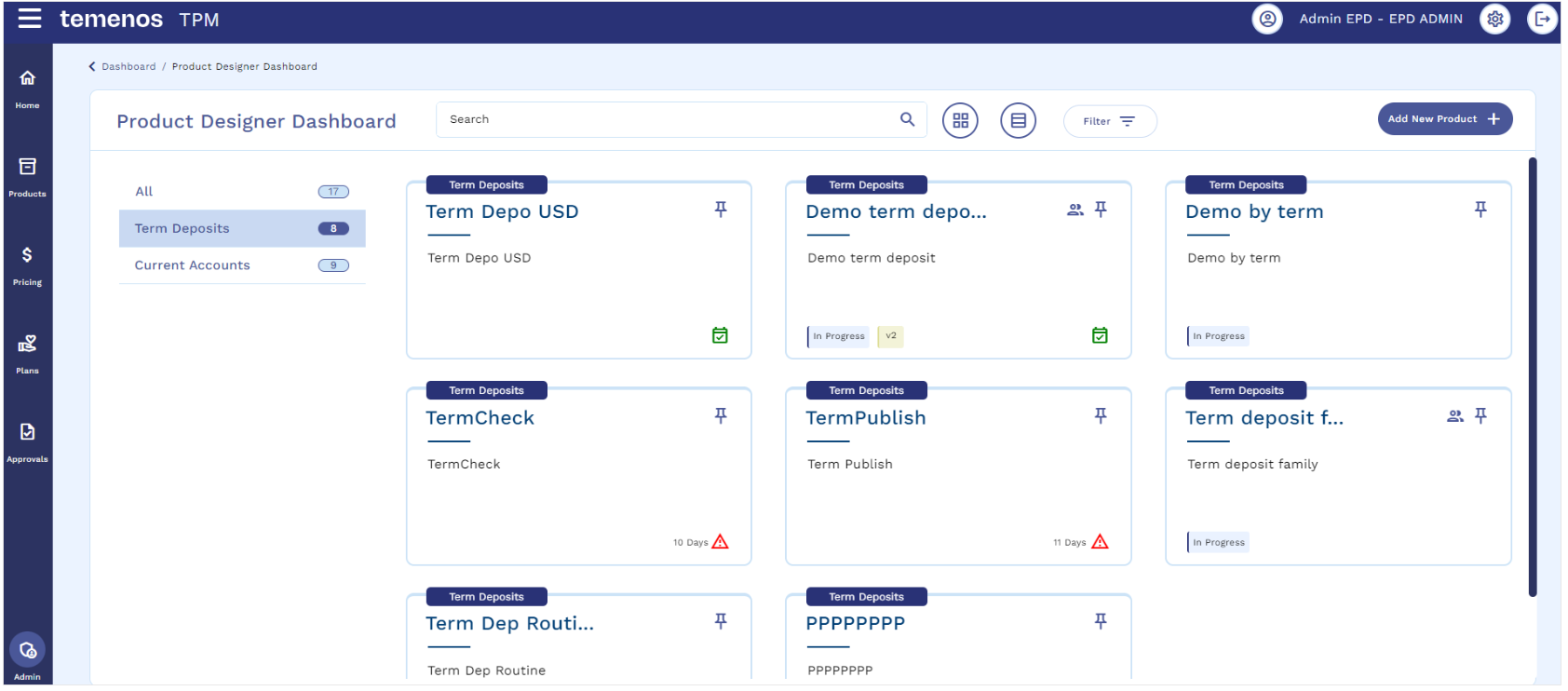

Temenos Product Manager (TPM) UA

Temenos Product Manager (TPM) is a centralized enterprise platform that allows business users to tailor and launch unique products within no time and with no code. TPM acts as a central repository to manage both financial and non-financial products regardless of the core systems servicing the product. TPM can handle various types of product creation from the available product types, for example:

- Account products - current account, savings account, overdraft account, and so on

- Term deposit products - savings plan, certificate of deposit, and so on

- Lending products - home loan, personal loan, mortgage loan, credit card, and so on

- Money market products

More information on TPM User Agent can be found at: TPM UA docs page

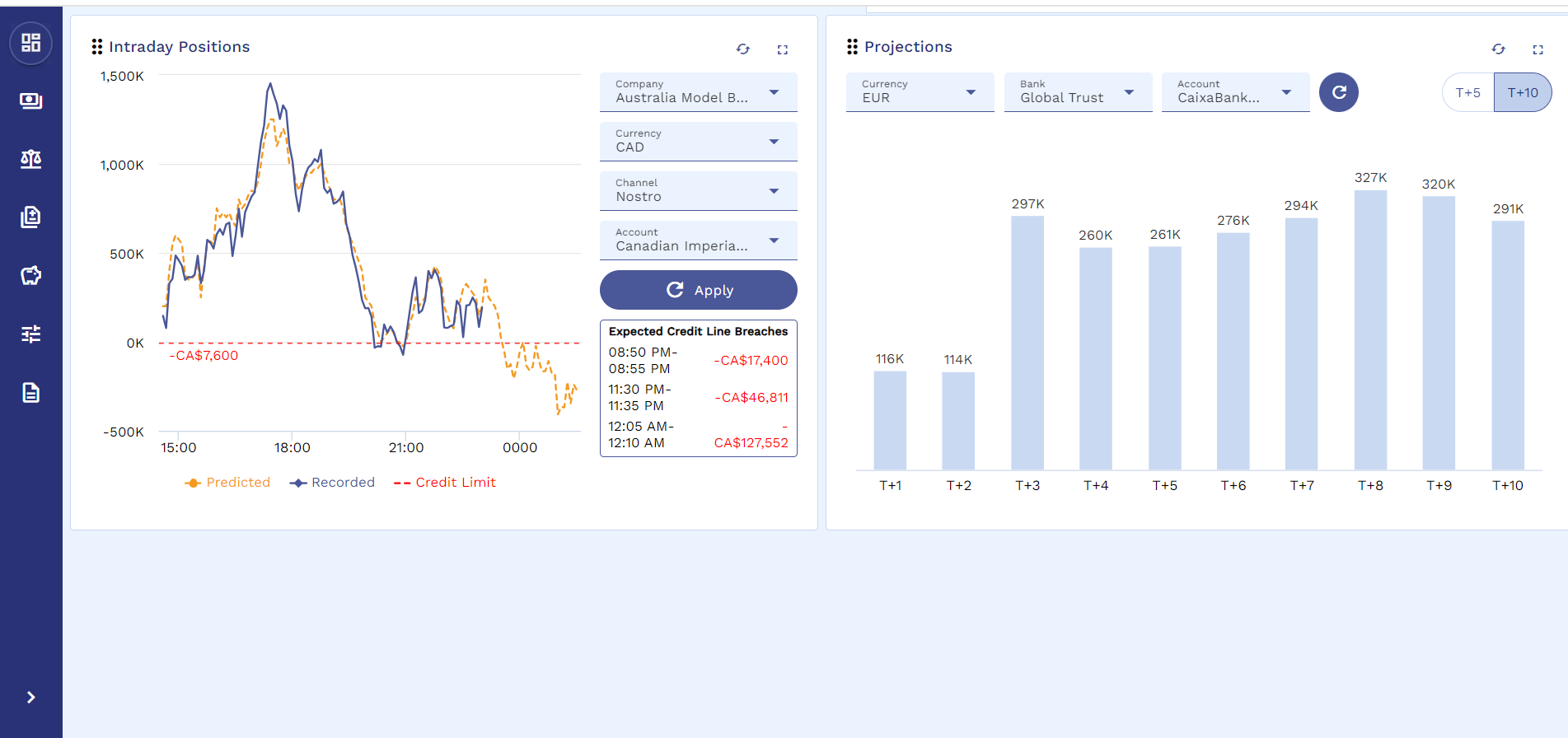

Liquidity UA

Intraday liquidity management is a vital facet of banking operations, focusing on the efficient control and optimization of available funds throughout the trading day. The primary aim of Intraday liquidity management is to ensure a bank has adequate liquidity to meet short-term payment obligations and respond to unforeseen financial demands, essential for financial stability, regulatory compliance, and seamless transaction processing. Intraday liquidity management software can bring significant value-adds to your bank:

- Real-time Visibility: Gain insights for quick decision-making in changing market conditions

- Liquidity Optimization: Minimize borrowing costs and allocate capital efficiently

- Cost Reduction: Cut overdraft, reserve, and non-compliance expenses

- Risk Management: Effectively address liquidity, credit, operational, and market risks

- Compliance: Easily meet regulatory requirements, avoiding penalties and reputation risks

- Operational Efficiency: Streamline processes, reduce manual work, and enhance team productivity

Liquidity User Agent provides users with near-real-time liquidity position monitoring. Whilst the main purpose of the system is to provide users with the ability to monitor their intraday liquidity flows, the solution allows the user to forecast liquidity, predict intraday balances, and set up thresholds and alerts with the adjustable business rules engine. It also has the ability to integrate seamlessly to existing third party systems. Temenos has aligned the Intraday Liquidity Management system to the “sound principles of liquidity management” as outlined by the BCBS, ensuring regulatory compliance as well as functional and practical use.

Key features of Liquidity UA-

- Account position monitoring - The cornerstone of the solution, this feature enables users to monitor available intraday liquidity near-realtime across various channels such as Nostro and Clearing accounts:

- support for different message types (i.e., MT, MX)

- separated into available and projected balances

- highly customisable – different views for cash ladders supported (i.e., account wise, currency wise, etc.)

- Business rules engine The engine provides users with the ability to define, set, and control additional rules, limits, and alerts. E.g. User will be able to set a upper/lower threshold for accounts. System wil be able to intimate users via alerts when the threshold is breached.

- Payment initiation (when connected to a payment engine)

- Support for manual sweeping.

- The solution allows the users to initiate account transfers between the bank’s Nostro accounts, liquidity transfers between dedicated cash accounts, and to the main cash account held within an RTGS system or other ancillary system.

- Predictive analytics Using Temenos XAI predictive analytics capability the system can arrive at more accurate and precise balance forecasts and recognise trends/expected behavior based on historic data. The XAI model and its predictions will continuously learn and adapt to the bank’s specific environment

- Liquidity forecasting Transaction data from core banking is sourced by Temenos Intraday Liquidity Management as inputs to generate liquidity forecasts – both for the given business day as well as ‘n’ days in the future

- Configure views In line with business roles and the ability to scale along with the business, giving the user control over their key metrics such as frequently used nostros, currencies, and adjustable credit levels and thresholds

- Alerts The system generates alerts based on the users’ predefined specifications, notifying them of expected intraday breaches and when management action may be required

Note: Liquidity UA development is in progress and is not yet released.